Managing Money with Digital Gaming

A forward-thinking couple’s foundation employs video gaming and digital storytelling to break through to people from all walks of life with money-savvy lessons

It was unsurprising that on their first date they talked about business strategies. After all, both Will and Cary Singleton grew up in households where their families ran successful enterprises. As the son of Teledyne Corporation founder and CEO Henry Singleton, Will had witnessed the birth of a major U.S. technology behemoth; and Cary’s family created and ran a successful engineering firm.

What was perhaps a bit more unusual was that their conversation in that first meeting quickly pivoted from business to philanthropy. What if they could make a difference in the lives of people who had not had the business backgrounds and education they had? Well frankly, that sounded logical. But they went further in their focus and took action that has actually transformed lives — a lot of them.

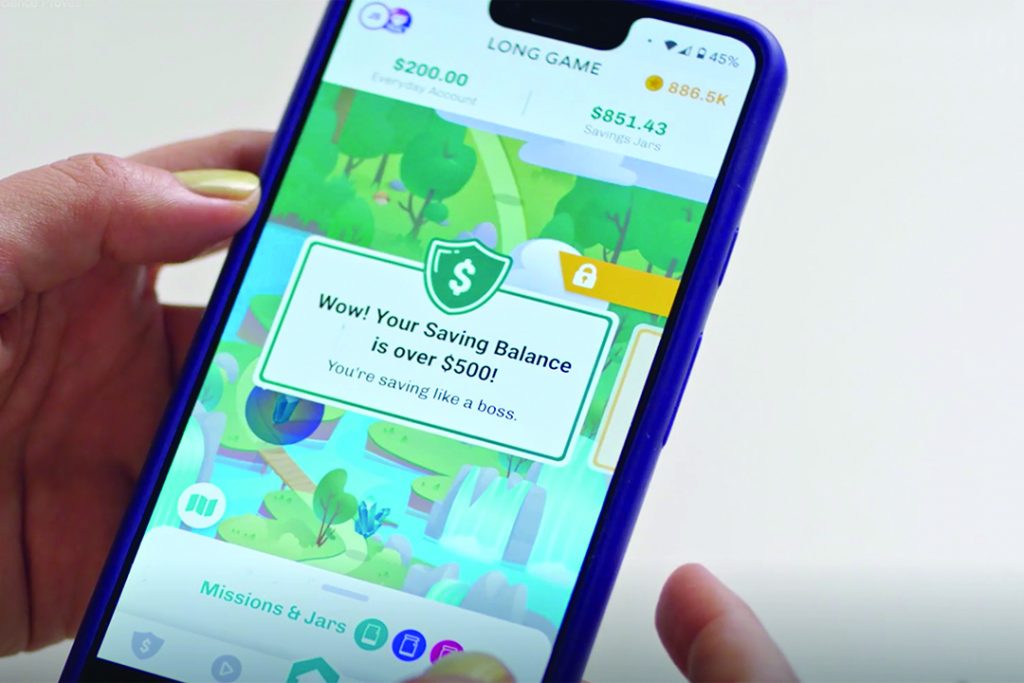

Today, happily married for over 10 years, the Singletons have turned that early conversation into a highly recognized entity known as the Singleton Foundation for Financial Literacy and Entrepreneurship. Its programs have been shared by more than 200 million people and counting. Through the power of entertainment in digital stories and video gaming, the Singleton Foundation is helping individuals set themselves up for better financial futures. The Million Stories Media series has earned their production team 12 Telly Awards — the equivalent of Oscars in the digital production world.

But what Will and Cary really care about is that people from all walks of life are learning critical skills through shows that focus on debt, home mortgages, how your brain thinks about money, how to secure a job or start a company, and nearly every other subject that could possibly help anyone struggling to make ends meet. Because they decided on the format of digital storytelling to get their points across, using familiar faces and real, relatable people in them, they are having an impact where traditional economic education publications have failed. What’s more, digital markers reveal that a high percentage of watchers actually do make progress — like getting out of debt or saving their marriages because they learned how to talk to their spouses about money. Now sponsors want in on the act and firms like Experian, Delta Air Lines, and Altair are beginning to underwrite the work initially funded over a half dozen years by the Singletons themselves.

Recently, I sat down with Cary and Will to dig a little deeper into their goals and plans to educate the masses about financial literacy.

Q: Will, for what seems like a century, many philanthropic organizations and companies have dedicated themselves to educating young people and adults about how to become more literate about things like debt and spending. What is different about your approach?

A: I’ll tell you what, storytelling with relatable, real people using some of the best digital entertainment writers and producers we could find has made all the difference. When people at all levels of society are spending multiple hours every day on their digital devices — we are reaching them with entertainment value right where they are. What’s more, they identify with the actors in our series and they can track them as role models for what they can themselves achieve.

Q: Cary, how did you find all these creative people and put them to work on your cause?

A: I’ll tell you that we decided if we were to be successful in this venture, we had to locate and engage the highest quality talent and management in the business — and we did. We hired people who not only had run digital production companies, but we also found people who shared our passion. After that, we also knew we had to be able to determine whether or not we were reaching our audiences. To do that we used top-notch assessment tools as indicators that would tell us whether or not we were actually making a difference in people’s lives. We were able to recruit talent to create and run all the digital assessment initiatives as well. And as the story goes, “that has made all the difference.” We have an extraordinarily talented and creative team totally dedicated to the cause we sought to make our life work. It’s incredibly fulfilling.

Q: But, Will, any skeptic would say that, after all, millions of dollars have been spent over many decades attempting to provide training in the value of money and how to use it; and we still have an abundance of people suffering from debt and insolvency every year. Why isn’t this taught in schools as a required curriculum?

A: That’s something that puzzles us as well. We have reached out to dozens of what we call partnership organizations. These are institutions such as the military and military schools where there has been a great interest in using our content. Our Venture Valley video game content is available to school districts through the Discovery Education platform. But you have to understand that today, teachers are rewarded financially for increasing test scores in math and reading, so they logically put an emphasis on curriculum-related programs that focus on that. It’s the true life skills that often suffer and are left to parents or after-school programs to remedy, and it doesn’t often happen. Old patterns of poverty persist in families without the ability to help lead the next generations out of these limits. That cycle has to be broken and we are dedicated to that.

Q: Lastly, Cary, give us a sense of what comes next.

A: The Singleton team is never at a loss for new, creative ideas. This includes games that focus on financial literacy and templates that provide roadmaps for people of all ages to start new enterprises and companies. The more we understand the digital marketplace and what users are focusing on next is where we want to be. We constantly listen to the consumer, and now that we have other businesses joining us in this effort, we are pleasantly surprised that they value not only the quality of our digital content, but also our process for discovering new shows that address where people are right now in terms of their specific financial needs. It’s a dynamic market and will be for a long time. We are also focusing on our nationwide annual awards program that features leaders in the business community who have conquered unique obstacles to succeed in business today. It’s all extremely gratifying and rewarding.

James Rosebush is the founder of the Intersection Impact Fund, a best-selling author, speaker, and CEO of GrowthStrategy, a corporate advisory firm.

Subscribe today and gain a strategic advantage from the emerging trends and best leadership practices found within Real Leaders magazine.

Responses